Strong Returns, Clear Terms: Our Investment Structure

Discover how Tally Capital & Partners delivers 7% preferred yearly cash flow and 18-20% average returns through transparent real estate investments.

Our Investment Strategy

We buy large multifamily complexes in growing U.S. markets, fix them up, and sell them for a profit after 3-5 years. Our strategy focuses on:

-

Class B Properties in Top (Class A) Markets

Well-maintained buildings in thriving cities with strong demand, offering stability and growth.

-

Class C Properties in Growing (Class B) Markets

Older properties in up-and-coming areas, where renovations can significantly boost value.

How We Finance the Investment

To acquire and enhance a property, we combine multiple funding sources:

Bank Loan (65-70%): We secure a low-interest loan, similar to a business loan, to cover most of the purchase price, keeping costs efficient.

Your Investment (25-30%): As our Limited Partners (LPs), you provide the majority of the remaining funds, earning returns without managing daily operations.

Our Investment (5-10%): As General Partners (GPs), we contribute our own capital, aligning our interests with yours..

Investment Requirements

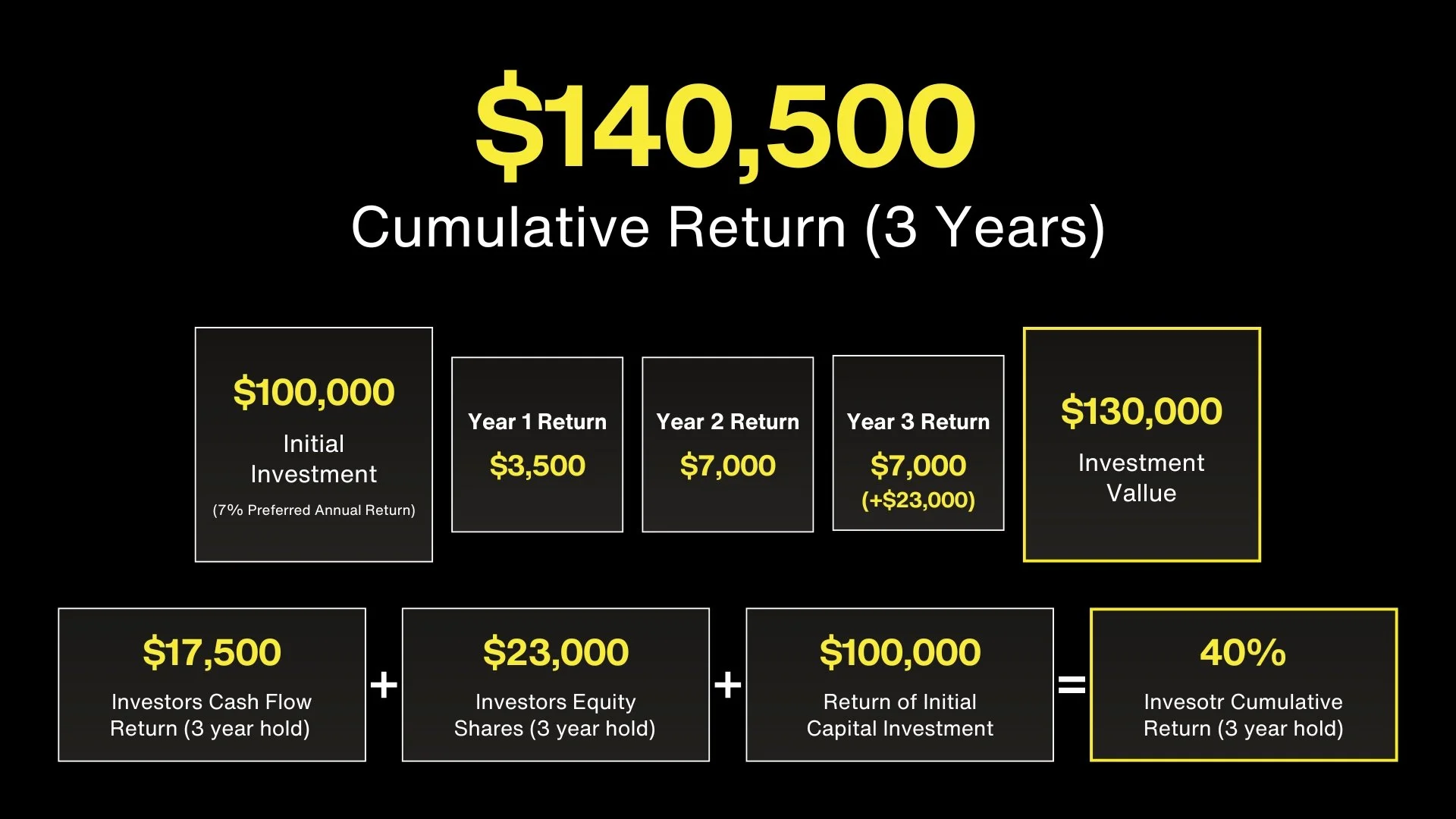

$100,000

Minimum Investment

Your investment enjoys a 7% preferred return paid quarterly, offering a steady income stream with potential upside.

How We Share Profits

-

You receive 7% of your investment each year (e.g., $7,000 per $100,000 invested), paid to you quarterly, as a preferred return for trusting us with your money.

-

When we sell the property after 3-5 years, we take the remaining profits and split them 70% to you and 30% to us, driving your potential annualized return to the 20-30% range.

Our Fees

-

Covers researching and securing the right property.

-

For property oversight and investor communications.

-

Covers managing upgrades that increase property value.

-

Compensates us for handling the property sale.

See Your Investment In Action

These are sample projections based on averages from past deals, not guaranteed outcomes. Use the toggles to explore.

The example shown above is intended for illustrative purposes only to showcase the potential of an investment and is based on averages derived from our past deals. These forecasts are based on current real estate trends (including occupancy and rent growth), Sponsor’s calculated estimates, and historical performance data, but they involve risks, variables, and uncertainties such as market fluctuations, renovation delays, or changes in interest rates. Sponsors make no representations or warranties that any investor will, or is likely to, attain the returns shown above, as hypothetical or simulated performance is not an indicator or assurance of future results. Actual returns may differ significantly due to these factors. Cash flow returns are less than the preferred return in Year 1 because distributions will not begin until the 3rd quarter after closing, reflecting the time needed to stabilize property operations. Please review the detailed financial disclaimers in the Private Placement Memorandum for further information.